Low-income families need free tax preparers, and VITA provides that and more

NEWARK, NJ—An overwhelming majority of low-and-moderate income families in New Jersey are losing out on critical tax benefits, unaware that they could benefit from filing or overwhelmed by the tax system, especially when finding affordable and reliable tax preparers appears nearly impossible.

During the financial crisis of 2008, Dauna Thompson was living paycheck to paycheck as a single mother in Montclair, taking on temp jobs to make ends meet. So, paying someone to do her taxes wasn't an option. "I had to find something free. I needed every penny," Thompson said.

Not only do tax preparers charge about $270 per return, but there are also no rules or regulations governing independent tax preparers in New Jersey, meaning just about anybody can be one.

With 10 per cent of households in New Jersey living under the federal poverty level and 27 per cent under the ALICE threshold, earning less than what they need to make ends meet, free tax preparation is critical to household sustainability.

After searching online for a free tax preparer, Thompson said she learned about the IRS Volunteer Income Tax Assistance (VITA) program and used their services for almost 14 years.

The VITA program is a free tax preparation service operating for more than 50 years across the United States, and there are many VITA sites across the state. They can be found through the IRS Get Free Tax Prep Help website, and many VITA sites provide services in other languages, from Spanish to Farsi.

VITA tax preparers are volunteers trained and certified in tax law by the IRS and save people money and help them claim tax credits they may not even know they qualify for, such as the Earned Income Tax Credit (EITC).

EITC is one of the most effective anti-poverty programs in the United States, but 25 percent of eligible families in New Jersey don't claim it annually.

After utilizing the VITA program, Thompson claimed tax credits such as the EITC, which helped her pay bills and rent without putting her in a tight spot before her next paycheck.

"I was a single parent," she said. "It helped me keep my bills on point. You know, where I could stay afloat."

But the issue of unclaimed tax credits doesn't stop there. There is nearly $415 million in unclaimed child tax credit in New Jersey.

Renee Koubiadis, the Anti-Poverty Program Director for New Jersey Citizen Action (NJCA), said there'd been an increase in families claiming those credits over the past few weeks. Still, as last reported in February, half of the eligible families in New Jersey hadn't claimed it.

Monica Conover, a VITA tax program lead at United Way of Northern New Jersey, said many families aren't claiming it because they're unaware of the tax return process to get the additional support or don't usually file their taxes.

Undocumented parents may not realize that they can file their taxes under an ITIN (Individual Taxpayer Identification Number) instead of a social security number. If their children have social security numbers, they can receive the child tax credit.

Anyone collecting social security, on social services or additional assistance must file a tax return to claim the child tax credit if they're raising children.

Families that had received monthly payments in advanced child tax credit may not know that they only received half and must file their tax return to get the rest.

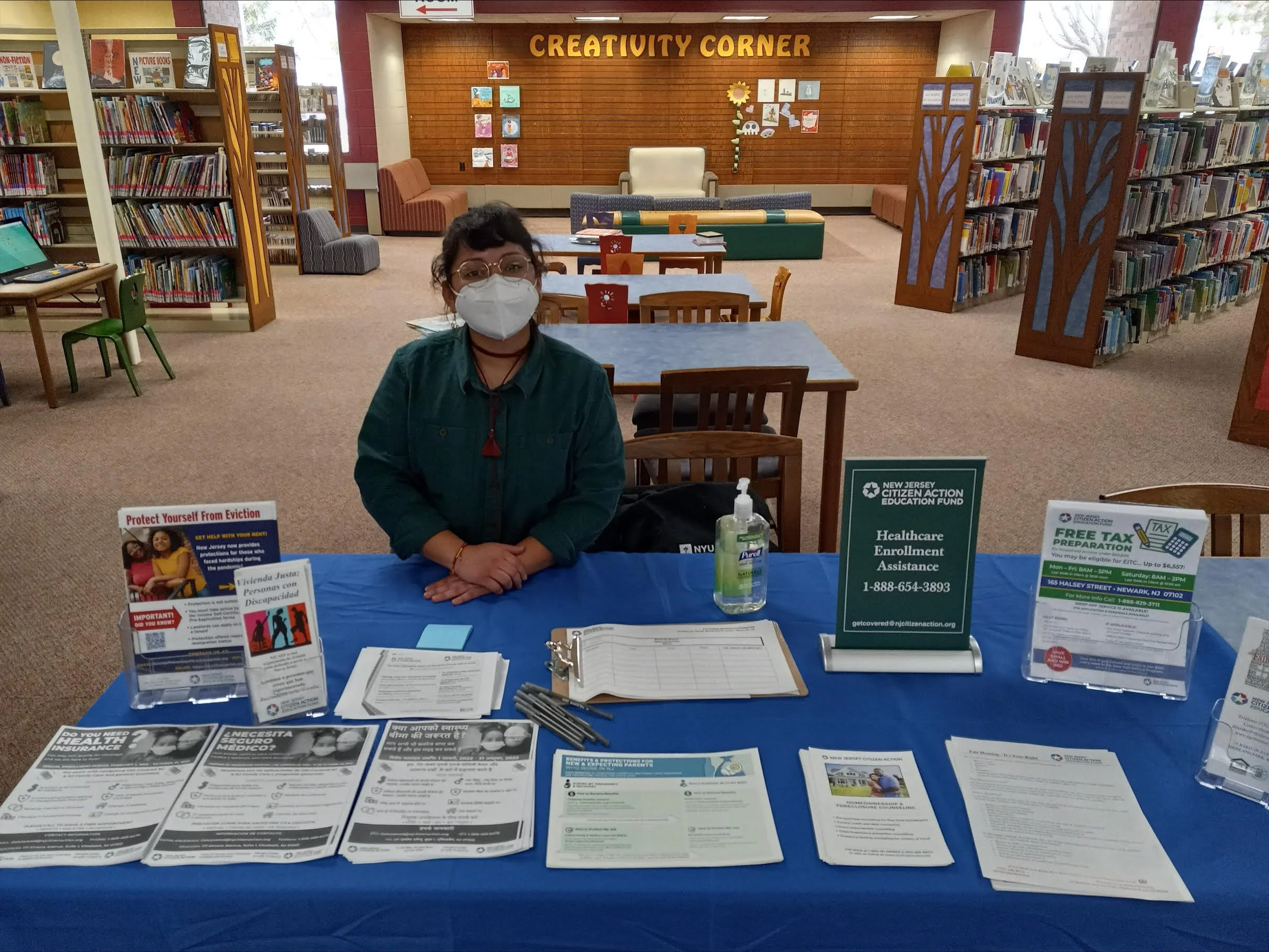

NJCA staff member, Jesika Tixi, at an outreach event at the New Brunswick Public Library to promote NJCA's free services.

Alina McKnight, a single mother of three from Newark, said she only found out about the VITA program because of her work for a nonprofit, which required her to find resources for the marginalized and underserved populations like the homeless and formerly incarcerated.

The advanced child tax credit money allowed McKnight to cover daily living expenses without borrowing money or taking on a second or third job.

"I have three girls. Getting another job is risky every single time," she said, and the money she received because of the child tax credit meant she could finally afford to do laundry more often and buy one of her daughters a new pair of glasses she couldn't replace a year before.

McKnight said she was also able to buy her oldest daughter an interview outfit for an after-school tutoring job.

"It was like a peace of mind," she said. "I can't buy you your Jordan's, but hey, you got brand new sneakers, your clothes are washed, you got a new uniform, the interview clothes. And she went in for the interview, and she was so confident."

Her daughter ended up getting the job, but McKnight felt a blow as soon as the monthly child tax credit ended.

Although the child tax credit lifted about 40 percent of children out of poverty, the poverty rate spiked again after it ended in December.

"Now that I don't have a lot of the assistance anymore, I'm feeling it," McKnight said. "I'm really feeling it because I'm back to struggling. I'm back to scavenger hunting."

VITA sites don't just help people prepare their taxes but teach people about taxes and finances and connect struggling individuals and families to services and referrals they may need. Other resources include access to Supplemental Nutrition Assistance Program (SNAP or food stamps), ITIN preparation, rental assistance and prescription drug programs.

Koubiadis explained that while the tax deadline is for people who owe the government money, people can still claim the child tax credit or EITC at the federal and state level after the deadline.

"You can claim those at any time, and we can help you do that with free tax preparation," Koubiadis said. "They can claim the money from two years ago if they didn't claim it then."

New Jersey Citizen Action has a VITA site or free tax preparation service on Halsey Street in Newark.

Although the VITA program provides a vital service for low-income and undocumented families, Conover said VITA sites across New Jersey do under 20,000 tax returns a year.

In a state with a population of about 300,000 people living in poverty and in need of assistance, VITA is meeting less than 10 percent of that need.

"So, we only really scratch the surface," Conover said. "There is really a huge need for this program. At this point, it's now getting the word out as much as we can to make people aware of it."

And depending on the VITA site, they may provide in-person tax filing services, or qualified taxpayers—single or married, income limits vary depending on the site—can drop off their documents or upload them through a virtual tax filing service.

"You don't get any better than that," said Thompson of the virtual service. "I'm getting ready to upload my information. Then they call you in to let you know when to sign your paperwork."

Taxpayers with a total income of $73,000 or less can also prepare their own federal and state taxes through free IRS-approved online tax software, a service United Way of Northern New Jersey can help provide.

"We are available to coach them if they need assistance, but this a pretty empowering thing, to learn how to do your taxes for free," Conover said.